Atal Pension Yojana is a Social Security Scheme which is initiated by the Government of India and it is aimed to provide a steady source of income after the age of 60 to all citizens of India. This pension scheme is focusing mainly on the middle-lower people working in the unorganized sector such as maids, delivery boys, gardeners, etc.

The main objective of the scheme is to make every Indian citizen tension-free about sudden illness, accidents or chronic diseases in their old age, providing a sense of security. Not only people working in unorganized sector, but private sector employees or the people working with an organization that does not provide them pension benefit can also take benefit of this scheme.

The Atal Pension Yojana (APY) scheme was launched in the 2015-2016 budget with the purpose of helping individuals working in the unorganised sector.

Key Features of Atal Pension Yojana

The following features of APY scheme are noteworthy:

Automatic debit

Automatic debit service is one of the main feature of the Atal Pension Yojana. The bank account of a beneficiary is linked with his/her pension accounts and the amount of contributions are directly debited every month. On that note, people who have subscribed to the APY scheme must ensure that their account has sufficient balance to enable automatic debit or it can attract a penalty in case of failing to do so.

Facility to increase contributions

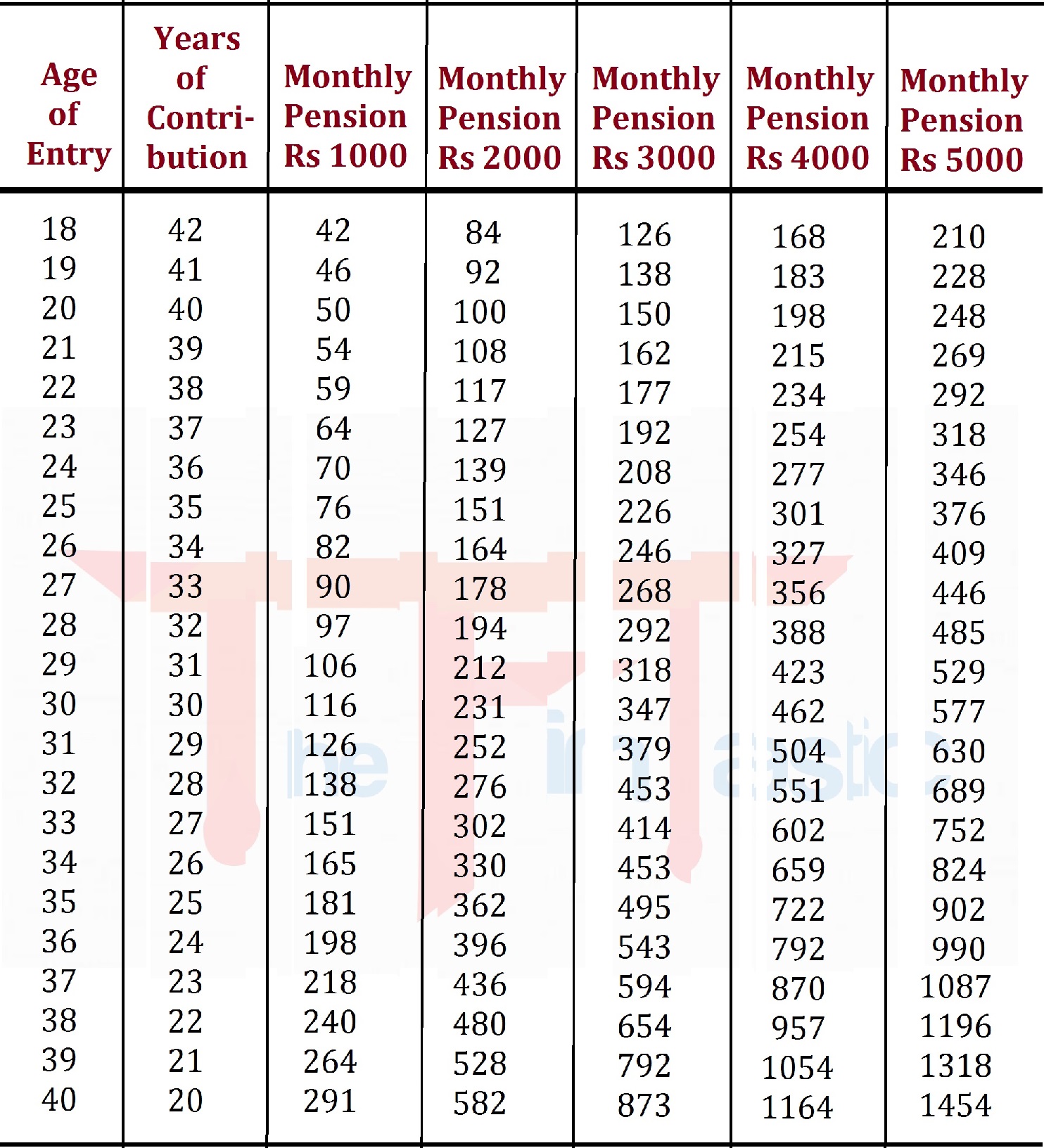

The pension amount is determined by an individual's contribution and a person is eligible to receive the pension amount after reaching the age of 60. There are different contributions for which pension amounts differs.

And, If the individuals decide to increase contributions to their pension account to secure a higher pension later, this facility is available in the APY. The government provides an option to increase and even decrease the amount of contributions once a year to change the corpus amount.

Guaranteed pension

Beneficiaries of the scheme can choose to receive a monthly pension of Rs 1000, Rs 2000, Rs 3000, Rs 4000, or Rs 5000, according to their monthly contributions.

Age restrictions

Individuals whose age is between 18 to 40 years of age can invest in the Atal Pension Yojana. Thus, college students can also get benefit from this scheme and create a corpus for their old age. 40 years the maximum age for entry into the scheme, as contributions to this scheme shall be made for minimum 20 years.

Withdrawal policies

After the age of 60, the beneficiary is eligible to annuitise the entire corpus amount and receive monthly pensions after closing the scheme with the respective bank.

To exit this scheme, one must be below the age of 60 and under circumstances like terminal illness or death, the closure can be made.

If a beneficiary dies before he/she reaches 60 years of age, his/her spouse is entitled to receive a pension. The spouse also has an option whether to exit the scheme with the corpus or continue to receive pension benefits.

If a person chooses to exit the scheme before the age of 60, he/she will only be refunded his/her cumulative contributions and interest earned thereon.

Terms of penalty

If a beneficiary fails to pay contributions at time, the following penalty charges will be applied:

- Rs 1 for monthly contributions of up to Rs 100.

- Rs 2 for monthly contributions between Rs 101 and Rs 500.

- Rs 5 for monthly contributions between Rs 501 and Rs 1000.

- Rs 10 for every month contributions of Rs 1001 or above.

If a beneficiary fails to pay for 6 consecutive months, his/her account will be frozen and if it happens for 12 consecutive months, that account will be deactivated and the amount thus accumulated along with interest would be given back to the respective person.

Tax exemptions

Individuals are eligible for tax exemption on contributions made towards Atal Pension Yojana under Section 80CCD of the Income Tax Act, 1961. Under Section 80CCD (1), the maximum exemption allowed is 10% of the concerned individual’s gross total income, but up to a limit of Rs. 1,50,000. An additional exemption of Rs. 50,000 for contributions to the Atal Pension Yojana Scheme is also eligible under Section 80CCD (1B) of the Income Tax Act, 1961.

An individual must consult a professional for these exemptions as such tax benefits can be availed based on specific provisions stated in the Income Tax Act.

If you choose to close the scheme before the age of 60 for any general reason, only your contribution and interest earned will be returned. You will not receive the government’s co-contribution and the interest earned on that amount.

Monthly Contributions

Eligibility Criteria

The following requirements should be followed to make investment in APY:

- A person must be an Indian citizen.

- A person should have an active mobile number.

- A person has to contribute to the scheme for at least 20 years.

- A person's age should be between 18 years and 40 years.

- A person must have a bank account linked with his/her Aadhaar.

- A person should not be a beneficiary of any other social welfare scheme.

- Other than that, individuals who are beneficiaries under the Swavalamban Scheme are automatically eligible and thus migrated to the APY scheme.

How to Apply?

Steps to apply for APY:

- All the nationalized banks provide the services for this scheme. You can visit any of these banks and open your APY account.

- Forms for Atal Pension Yojana are also available online at the official website of Government.

- The forms are available in these languages: English, Hindi, Bangla, Gujarati, Kannada, Marathi, Odia, Tamil, and Telugu.

- Just fill up the details asked in the application form and submit it to your bank.

- You will have to provide a duplicate copy of your Aadhaar card along with the application form.

- You will get a confirmation message when your application will be approved.

No comments:

We welcome encouraging, respectful and relevant comments. Thank You!!