GST impact on the Gold

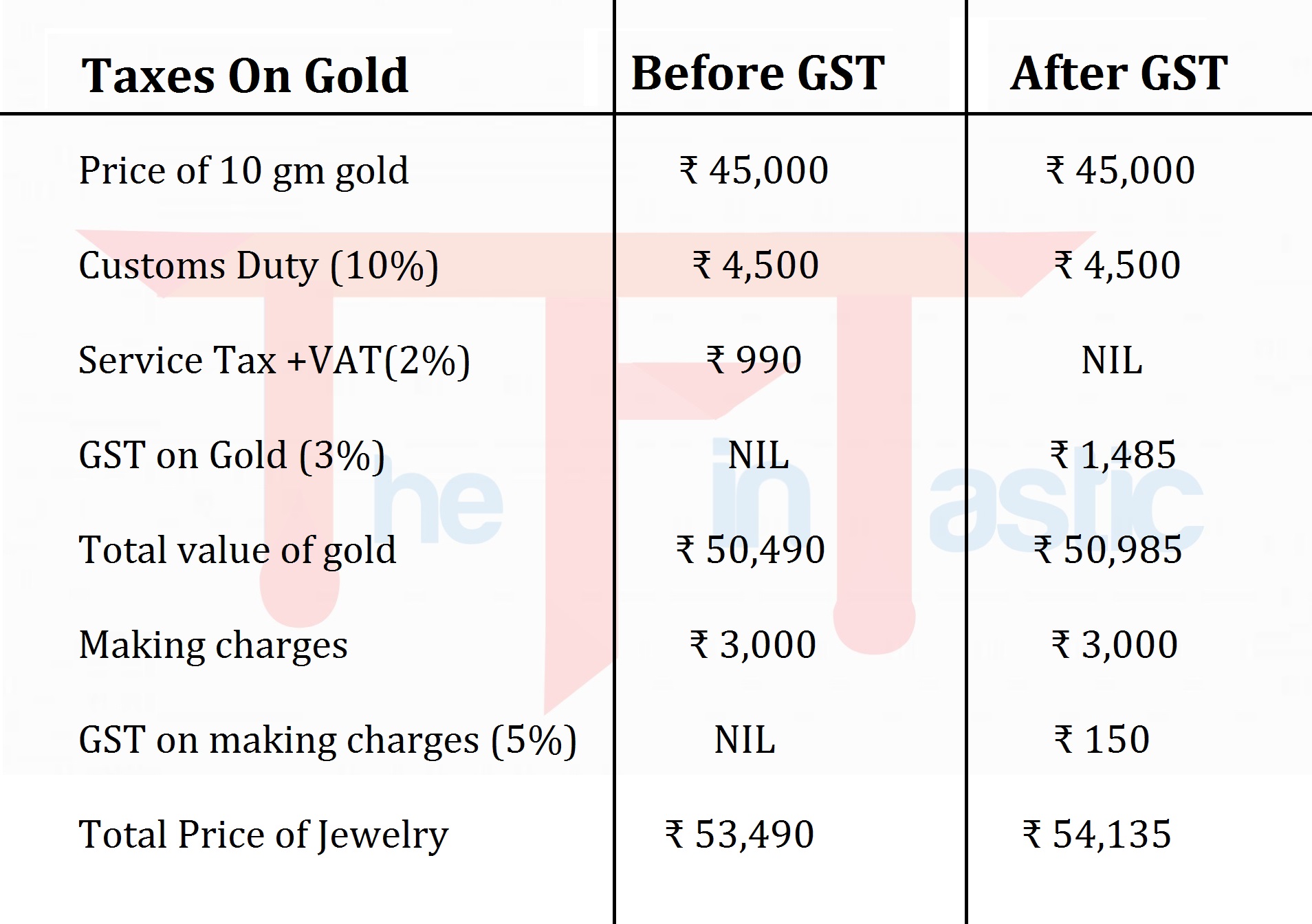

To understand the impact on gold price after the implementation of GST, let's see an example. Suppose the price of 10 gms gold (24K) is ₹ 45,000 and the import duty of 10% is charged on gold. Further, the making charges of gold is ₹ 3,000, the price of gold before and after GST will be as per the following image:

Gold GST Rate on Gold Value

After the implementation of GST, a tax of 3% is charged on gold and gold-related jewellery above the price of the gold. This cost is passed to the final consumers when they purchased the gold ornaments. Before the GST, a service tax of 1% and VAT of 1% was charged on the price of the gold. Thus, GST increased the gold rates.

GST on Gold Ornaments

In India, most of the raw gold is imported from other countries, which is then used for making gold ornaments. While before GST, there were no making charges on the gold. However, a GST of 18% was levied on the making charges of gold when goods and services tax was implemented in India, which was eventually reduced to 5% because of rising concerns and protests. Presently, the consumer has to pay 3% GST on gold value and 5% GST on making charges.

Revised Tax Rates on Gold Jewelry under GST

Before GST, a service tax and VAT (Value Added Tax) of 1% each was charged on gold. Thus, an additional 2% tax was charged on the selling price of the gold which was paid by the consumers at the end. Gold became more expensive when the GST of 3% was decided on the gold. However, the relief was also provided as gold making charges were reduced to 5% which were 18% before GST. In India, most of the gold is imported from outside to make jewellery and the import duty of 10% is levied on the import of gold, which makes gold imports more expensive.

Exemption of GST on gold

Under the scheme for ‘export against supply' by the nominated agency, the government issued a list of notified public and private sector banks which were exempted from paying GST on imports of gold, which gave a huge relief to the notified banks. However, there was no change on the gold rates for the gold vendors with the decision taken after the 31st GST Council meeting on 22nd December, 2018.

Buying Gold Jewelry: Key Factors to Keep in Mind

The gold is considered as auspicious in India and it is also a good option for investments. Here are a few things that you must remember while buying gold jewellery.

The purity of gold: The most important factor while buying the gold is its purity. The purity of gold can be determined using hallmark, which is accredited by the accrediting agency ‘The Bureau of Indian Standards’ (BIS). The hallmarked jewellery will have a number attached to it along with a BIS stamp on it. You can look for the letter K along with the number on the jewellery. 24K gold is pure gold or 100 percent gold.

Cross-check the gold price: The price of the gold jewellery is based on its weight and purity. For example, the price of 22 carat gold of 10 gm will be higher than 18 carat gold of the same weight. The price of gold changes every day with the change in gold rate. It will help if you cross-check the gold rates before buying the gold.

GST rate on gold: The GST rate of any precious/semi-precious stones on the gold jewellery is different from gold. You must verify that such charges are separately mentioned in the bill. Under the GST, 3% on gold value and 5% making charges are charged on the gold jewellery. The sellers may also include labour charges in the form of making charges. You must thus discuss with jewelers to reduce this cost.

Effects of GST on Gold

At Present, the organised gold sector in India comprises 30%; however, it is concluded that the high rates of gold will force the vendors to move to the illegal gold sector and import gold illegally. Further, following points will explain how the gold industry has been affected with the implementation of GST:

Impact of GST on gold value: GST increased the gold prices for the final consumers. It is because earlier 2% tax (1% service tax and 1% VAT) was charged on the gold which is now 3% under the GST.

Impact of GST on gold imports: The implementation of GST has increased illegal smuggling of gold imports especially from the middle east. It is because the import or custom duty of 10% is charged on the gold prices along with the GST of 3%, thus increasing the custom duty on gold imports.

(Also Read: GST on Laptops, Computers and Other Accessories)

No comments:

We welcome encouraging, respectful and relevant comments. Thank You!!