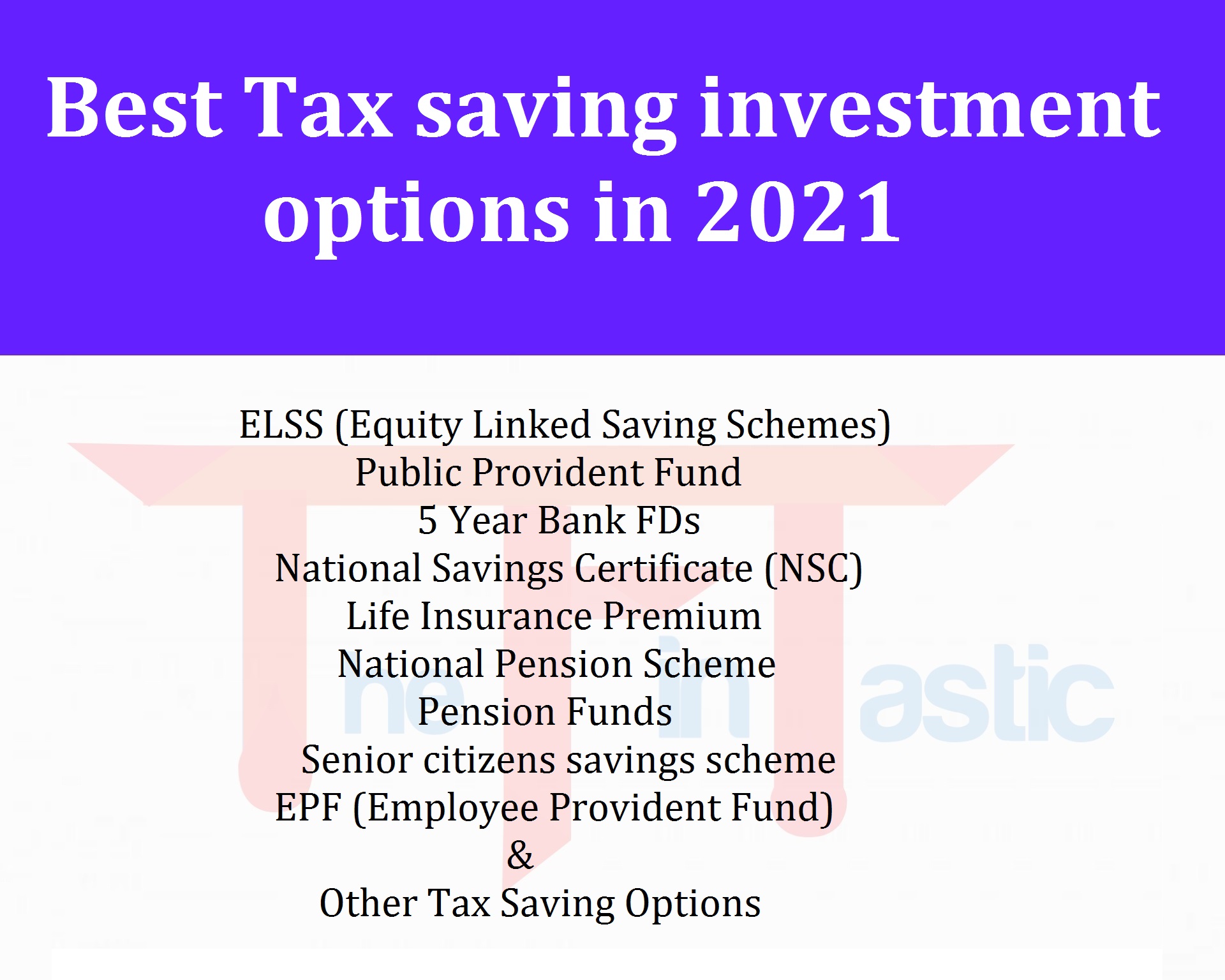

Best Tax saving investment options

ELSS Tax Saving Mutual Funds

ELSS (Equity Linked Saving Schemes) are a kind of equity linked mutual funds. As they invest in equity or stocks, ELSS funds can convey better returns - 14-16% over the long term. That is an entire 6-8% above inflation. This return isn't ensured however yet authentic proof recommends that these returns are reachable over the long term.

ELSS funds have a lock-in period of just 3 years – the most minimal among the options accessible.

Public Provident Fund

PPF is a decent option on the off chance that you are looking for an option with certain returns.

Your PPF investments acquire interest at a rate declared each year – right now 8.7%. PPF return is thusly generally at standard with inflation. Be that as it may, it is tax-free and you can do a lump sum or small regular investments.

5 Year Bank FDs

This is a variation of the regular Bank FD with a 5-year lock-in. They offer somewhat higher interest rates contrasted with ordinary FDs (0.25-0.5% higher) yet doesn't offer liquidity option-even premature withdrawal with the penalty is beyond the realm of imagination.

The amount you can invest is up to Rs 1,50,000. The interest you procure on your 5-year bank FD is fully-taxable and you should pay taxes consistently for the interest you acquire for that period.

TDS normally gathered by banks is just 10% (20% on the off chance that you have not submitted your PAN) and in the event that you end up being in the 20 or 30% tax bracket, you need to pay the outstanding interest while filing the IT returns.

National Savings Certificate (NSC)

NSC interest rates are fixed in April consistently. The current rate of interest is 8.5% for 5 year lock-in NSCs, and 8.8% for 10 year lock-in NSCs.

The interest collected is fully taxable. In any case, one key contrast here is that the interest amount isn't paid out to the investor. Instead, it's re-invested in NSC and hence can be considered as your investment in NSC for the ensuing year. Obviously, this is intricate.

Investments up to Rs 150,000 are eligible. You can invest in NSC by means of your local post office.

Life Insurance Premium

This was nearly the default tax saving option for quite a long time, However, throughout the most recent couple of years, most informed investors have taken in the dangers of choosing this option.

There are 2 kinds of Life Insurance Policies:

- Pure risk additionally called term life which guarantees a risk to the life of the insured

- Risk + investment: which pay you back money over the long haul

While pure risk life insurance is something everybody with a dependent must have, it's not an investment. Life insurance is a cost something you pay to guarantee that your dependents are not left abandoned should something shocking happen to you. Term life insurance is modest and for a sum of about Rs 10,000, you can buy a front of Rs 1 crore.

(Also Read: Best tax saving investments in 2021)

National Pension Scheme

National Pension Scheme is a ton like investing in mutual funds with its Safe, moderate and Risky options. The returns are not ensured.

You can't withdraw until 60 and the corpus amount should essentially be invested in an Annuity. The withdrawals are likewise taxable.

Contributions to the limit of Rs 150,000 are eligible for deduction under Section 80C. You can invest by means of the predetermined rundown of NPS fund managers with points of quality operated through banks.

Notwithstanding, given the restrictions that accompany NPS, it's not a suggested option.

Pension Funds

Pension funds are intended to furnish you with an income stream post retirement. They come in two types: Deferred Annuity and Immediate Annuity.

For deferred annuity plan, you invest yearly until your retirement. When you arrive at your retirement, you have can withdraw up to 60% of your amassed corpus and need to re-invest the remaining in an annuity fund which will give you a month to month pension.

With regards to immediate annuity plans, you invest a mass amount one-time and get month to month pension from the following month itself. You would ordinarily utilize these to invest your retirement corpus.

Senior citizens savings scheme

The senior citizens savings scheme is an item focused on senior citizens to save tax. It must be opened by individuals who are over 60 years of age.

There is a most extreme cap of 15 lakhs and a lock-in period of 5 years. You may withdraw the money before they become a subject to penalty as follows:

- Over 1 year however under 2 years – 1.5% of deposit amount

- Over 1 year however before maturity – 1 % of deposit amount

This plan is offered through the post office. Investments up to Rs 150,000 are eligible.

EPF (Employee Provident Fund)

For salaried employees, this isn't really an optional thing. You should follow your company's policy with some breathing space accessible. Nonetheless, many individuals fail to remember that the amount added to EPF is additionally eligible for 80C deduction.

EPF is ordinarily deducted from your salary consistently and it includes 12% of your Basic salary + DA up to a greatest limit of INR 6500 every month (inclusive of the optional matching employer contribution).

Other Tax Saving Options

Aside from voluntary contributions we make, there may be some constrained savings/expenses that as of now fit the bill for tax saving.

Tuition Fees for Children

Tuition fees for up to two children are covered under section 80C. If you don't mind note that it covers tuition fees just and not development fees or donations.

Home Loan Principal Repayment

You are eligible for tax exemption for the repayment of your home loan principal. Do take note of that the interest part isn't eligible for tax benefits.

No comments:

We welcome encouraging, respectful and relevant comments. Thank You!!